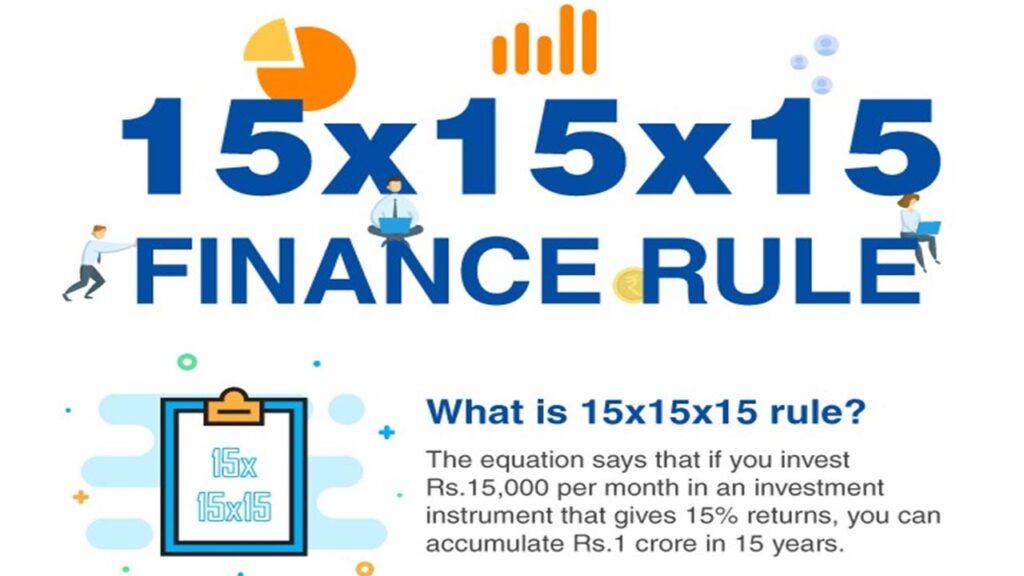

Yeah, you heard me right. You can become a crorepati by employing the straightforward 15:15:15 techniques. It simply means to invest Rs. 15000 for 15 years at the interest rate of 15%. You may be wondering where you would receive a 15% return at this point. which is the asset kind that would generate a 15% return. The asset type with the potential to deliver a 15% compounded yearly growth rate return is equity. However, Cryptocurrencies are a type of asset class that is not legal tender but has produced profitable returns. Governments do not support cryptocurrencies, and they have not existed from a very long time. Therefore, the only asset class that is legal and has the capacity to produce high returns is equity.

Power of compounding

Before going further let us understand the power of compounding the power of compounding refers to the ability of an investment to generate returns that are not only based on the initial investment, but also on the returns generated from that investment over time.

For example, let’s say you invest Rs 1,000 in a savings account that earns a 5% annual interest rate. After one year, your investment would be worth Rs 1,050 (the original Rs 1,000 plus 5% interest).

However, if you leave the Rs 1,050 in the account for another year and it continues to earn a 5% interest rate, the interest earned on the original Rs 1,000 investment would now be Rs 52.50 (5% of Rs 1,050). This means that after two years, your investment would be worth Rs 1,102.50 (the original Rs 1,000 plus Rs 52.50 in interest earned from the second year).

As you can see, the longer you leave your investment in the account and the higher the interest rate, the greater the returns generated by the power of compounding. In this example, after 20 years, the investment would be worth Rs 3,958.

The Power of Compounding is that it can help your money grow faster over time. The longer you invest your money, the more it can compound, and the more it can grow.

Let’s explore the 15:15:15 investment rule now

You can invest a relatively small sum each month through SIPs (systematic investment plans) in equity mutual funds to build up a sizable corpus for retirement. But did mutual funds truly provide returns of 15% over the past 15 years? Yes, there are a few mutual funds that have provided returns of more than 15% during the past 10 to 15 years. However, there is a catch: This return also includes the tax that must be paid if the funds are sold. Additionally, all mutual funds have expense ratios that can potentially eat away your earnings.

Does the well-known 15:15:15 rule of mutual funds, which is used in the financial sector, apply in actual life? Definitely not. Logically, after deducting taxes and other costs, one may only expect returns from mutual funds of up to 10-12% CAGR.

These are the myths that exist in the financial sector that are not true. However, in order to reach a financial objective, the number of years or the duration of the investment must be expanded. Returns of between 10 and 12%CAGR are possible. This rule can be altered to suit an individual’s needs. For instance: 20:20:10 This approach appears to be at least financially workable because as the tenure lengthens, the money also compounds in the higher phase. After 20 years, the corpus would be close to Rs 1.5 crore, and even after-tax payments and expense deductions, the remaining sum would be higher than Rs 1 crore. Make your own rules, then!

Conclusion

In the modern world, there are many misconceptions concerning financial independence. Basically, in a nation like India where a very small percentage of individuals are exposed to stock markets. And the majority of our ancestors in India believed that investing in stocks was incredibly risky. They ultimately invest or save the majority of their money in fixed deposits or gold. The earnings from FDs do not outpace inflation, nor do the returns from gold investments make your money grow more quickly. Even though the gains from gold may outpace inflation overall, you would still be at breakeven point. Equity is the only remaining choice, and it has the potential to outperform inflation, increase your income, and produce some positive returns.

Therefore, individuals can alter the above rule of 15:15:15 depending on their appetite for risk.

However, if you look logically, it is impossible to achieve a 15% CAGR return over a 15-year period every time. In order to avoid falling into the trap of taking out a loan from the bank or borrowing money from friends, I advise the younger generation who are just starting their careers to take risk and invest in risky investment opportunities like equity while also having some cash set aside for emergencies.

Key takeaways

- If sufficient planning is done, investing in stock is not highly risky.

- Don’t invest in the avenues which do not outperform inflation

- Begin investing young so you can reach financial independence quickly

- Understand the power of compounding